There might be affiliate links on this page, which means we get a small commission of anything you buy. As an Amazon Associate we earn from qualifying purchases. Please do your own research before making any online purchase.

Life can be hectic.

Especially as you get older.

Think about it…

When we were young, our parents took care of things.

They did all of the running around.

The planning.

The shopping.

The finances.

And somehow, they managed to save enough money to take us on a vacation.

Or buy a new car.

Put presents under the Christmas tree.

But now you’re the adult… at least, physically.

You’re 18 years or older and need to think about saving some money.

Whether it’s as simple as paying down credit card debt… or as big as saving up for your wedding… Digit can help.

And it’s simple.

How? Well, I’ll tell you.

In this review I’ll cover:

- What Digit is

- How it Works

- Simplicity of the App

- How much it Costs

- Cancellation Policy

So let’s get down to business and start saving!

(Side note: Another positive way to improve your life is to read and learn something new every day. A great tool to do this is to join over 1 million others and start your day with the latest FREE, informative news from this website.)

What is the Digit App?

Digit is the first completely automated savings tool… designed to help you save money.

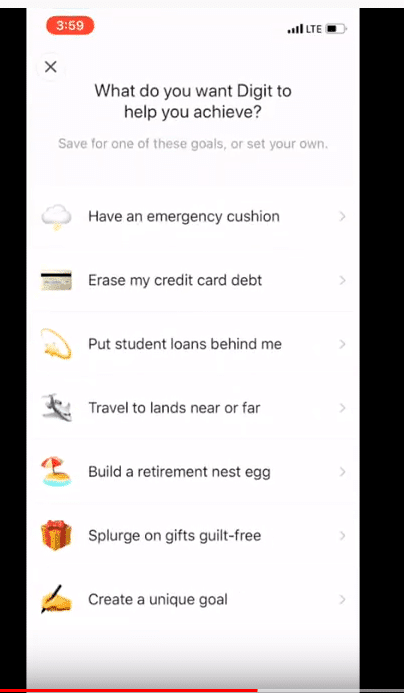

The app asks you to set personal goals… and there is no limit to the number of goals you can set.

You can use Digit to save for a rainy day, a vacation, or a friend's birthday gift.

You can go bigger… like saving for a house or boat!

Or, you can simply pay down debt or save up money to invest.

And you can move your Digit savings to your checking account as often as you wish without any transfer fees.

Sound too good to be true?

Well, there is a lot about Digit to like.

Unlike other money saving apps, not only are their no fund transfer fees… but Digit doesn’t require the account to stay above a certain amount.

And there is free overdraft protection.

Say what?

That’s right, because Digit is taking control of your savings… they feel kind of responsible for your cash flow.

The app’s unique algorithms are able to adapt your savings based on your spending.

However, for those algorithms to work properly, you must have everything funneling through the checking account you link to Digit.

Income such as paychecks… as well as recurring bill payments, credit cards, gas, groceries, etc… should all be visible for Digit to work properly and save effectively.

Every day, Digit is tracking your spending habits and then moving money from your checking account to your Digit account… if you can afford to.

Digit basically learns when and how much is safe to save… based on your spending habits. And so you will never be forced to come up with a fixed amount of money to transfer every month.

For example, the app will recognize that money is tight when your property taxes are due, and put less away that month.

Or maybe you had an unexpected medical expense… Digit will play it safe and be conservative with the transfer.

If it makes a transfer at all.

Stress free savings is what Digit is all about.

If you are more the conservative type, Digit recently launched a new feature allowing you to set a daily maximum limit on how much you want the app to save.

Withdrawals from your Digit account are also free and available at any time… if you find yourself short on cash.

Conversely, if you save for 3 consecutive months, Digit allows you to earn 1% annually on your total savings earned to date… paid automatically every 3 months.

That's 15x’s more than most savings accounts… and up to 100x’s more than most national banks.

Speaking of banks… Digit also uses state-of-the-art security measures which means that your personal information is anonymized, encrypted, and securely stored via bank-level SSL 128-bit encryption.

All funds held within Digit are FDIC insured up to a balance of $250,000.

The app is available for both iPhone and Android.

How Does Digit Work?

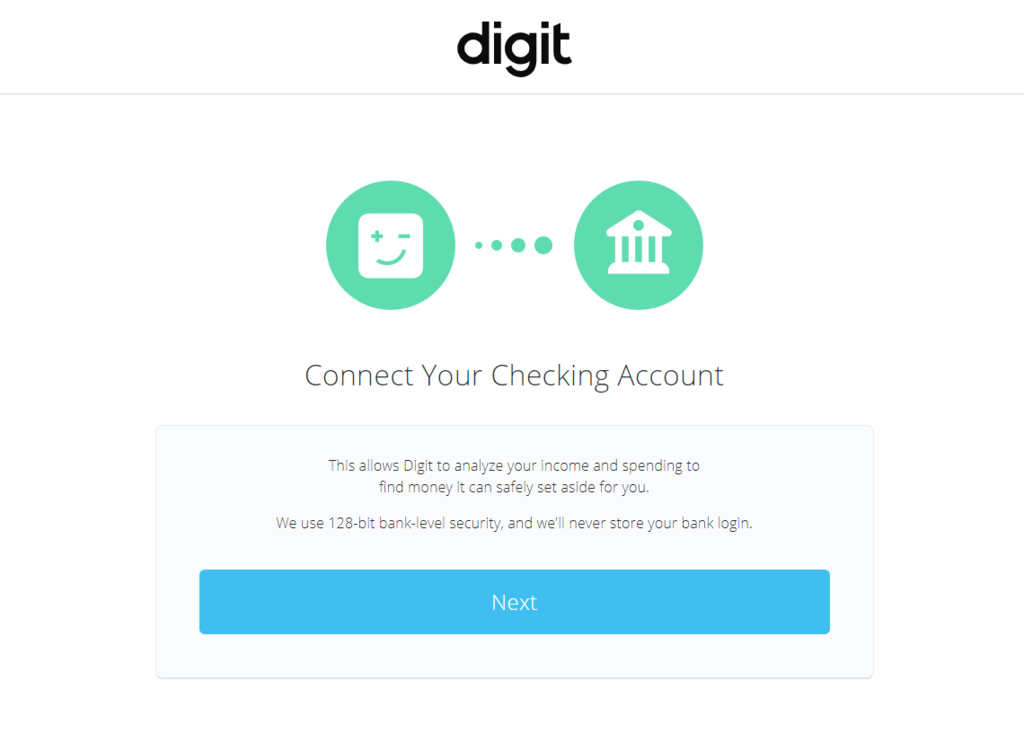

To sign up, Digit will ask for your mobile phone number and a password.

You will receive a text confirming registration.

Once that is done, you’ll be asked to connect a bank account.

You won't need your checking or routing number… but you will need to enter your account username and password.

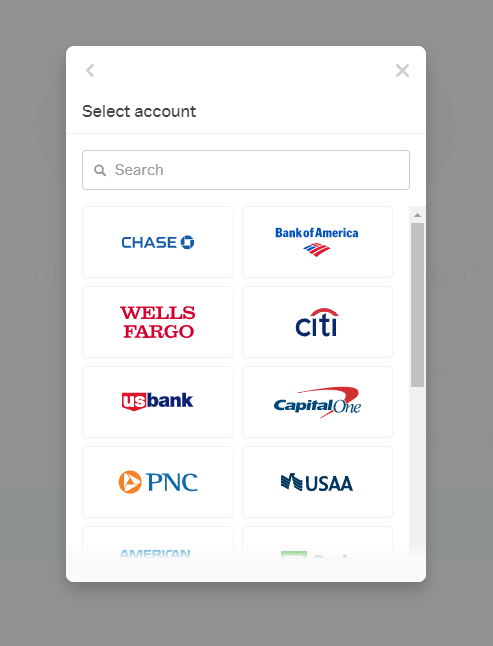

There is a list of common banks, but you also have the ability to search for others not listed… such as PayPal.

Initially, I had trouble with linking my bank account. In fact, I tried two separate accounts and neither worked.

In the help center, this seemed to be a fairly common issue that Digit assures customers they are working on.

Perhaps it was a security precaution on my bank’s part, but at the time of this

article… that remained unclear.

However… in the “help” section, Digit recommends trying to link bank accounts from the online site rather than mobile app if you’re having trouble.

Once your bank account is successfully and securely linked, the app should be ready to go… and Digit will analyze your spending and automatically move money from your checking account to your Digit account when you can afford to do so.

If they move money and it causes problems, such as an overdraft on your checking account, Digit will refund the money for up to 2 transfers. See more on that here.

And that’s basically it!

From the get go, you save money without realizing it.

How Does Digit the App Help You Save Money?

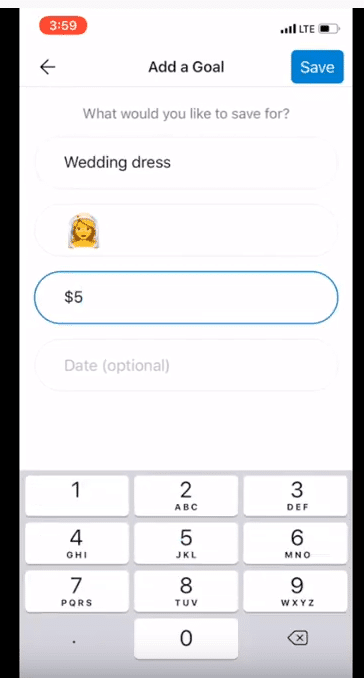

So you can set as many goals as you want with the Digit.

Each time you set a new goal, you’ll be asked to:

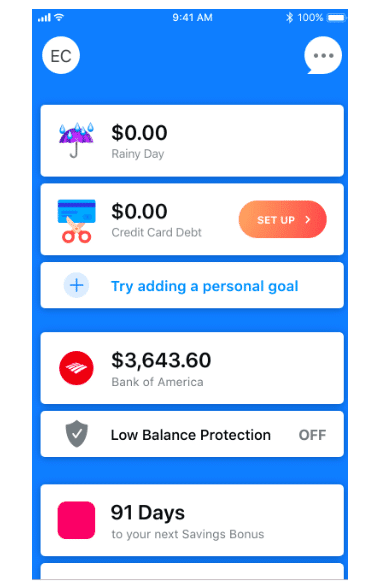

Simply, tap “Try adding a personal goal” in the Digit app.

You’ll be shown a list of suggested goals… but also have the option of creating you own.

You can even dress it up with a clever description or emoji for reference.

Once you’re done, simply tap “Save”… and Digit will take care of the rest.

The norm is for Digit to disperse an equal amount of money among multiple categories.

For instance, if you have 5 active goals and Digit thinks you can safely save $15 that day… each goal would get $3 allocated towards it.

However…

However…

There is also a nifty little feature called “Boost”.

“Boost” can be applied to any goal that you're saving for… at any time.

And what it does is increase the amount Digit will set aside towards that specific goal, provided it’s safe to do so, for as long as “Boost” is enabled.

So, if you were to follow the same scenario as above… you may see 4 of those 5 active goals only get $2 that day and the “Boosted” goal get $7 – still totalling $15.

You can boost as many goals as you'd like for as long as you'd like to help you reach your desired goals sooner.

We’ve talked a lot about savings, but If you are looking to Digit to help you pay down credit card or loan debit, there are a few things to know.

You can link a credit card or loan directly to your Digit account… but payment transfers can take as many as 3-5 business days to post.

Also, this is meant to act as a supplemental loan repayment… not your regularly scheduled monthly payment.

During the month, Digit will save to a goal designated just for your credit card (or loan)… and automatically send payment on the date you’ve selected.

If there are any problems at any time, Digit is proud of its 24/7 customer support team… which offers an actual human being to speak with, not a robot.

How Much Does Digit Cost?

So… cost.

It almost always boils down to that, doesn’t it?

After all, you are contemplating using Digit to save money… not add one more thing to your monthly expenses column.

Well, that being said… the current promotion is 30 days for free.

At which point you will be billed $5 per month.

Note: This amount went up sometime in the last few months, as it was only $2.99 per month in May of 2019… but with a 100 day trial period.

Some may see $60 per year as a negative, but if you think about what you spend on things like coffee or yoga in one month… it’s really just a drop in the bucket.

Especially if you are saving more than $5 per month with Digit to make up for it.

What is Digit’s Cancellation Policy?

Say you’re not sold on Digit… they offer a hassle free cancellation link.

They will, however, ask you some questions… and try and get you to stay.

Which is ok.

Stick to your guns.

Do what is best for you.

Should you elect to continue with the cancellation process, any remaining funds in your Digit account will automatically be transferred back to your originating checking account by the next business day.

In the unlikely event there is any trouble transferring your remaining funds, Digit will keep your contact information for up to 90 days in case they need to get in touch with you.

During that time period, if you decide to give Digit another try, you can log back in to reactivate your account.

Also keep in mind that simply deleting the Digit app does not close your account or pause savings activity.

But why would you want to cancel Digit?

I can’t think of a reason.

At least, not a good one.

My Final Review of the Digit App

Look, there are imitators out there.

Apps like Acorn, Mint, Qapital, Robinhood, Wealthfront, SigFit… to name a few.

And they each have something to offer… and so I do recommend doing your research.

After all, it’s your hard earned money we are talking about.

That being said, in a life filled with constant scheduling… juggling… running… wouldn’t it be nice to just have one thing taken off of your plate?

Savings with Digit is brainless.

You simply set up the account and let Digit take care of the rest.

Inspiration and clever memes come via text message once per day… letting you know just how much you’ve saved and what your balances are.

It’s almost like having a personal assistant.

Achieving the goals we set for ourselves is something almost everyone craves.

It’s human instinct to feel happy when goals are met.

Savings are accrued.

Debts are cancelled.

Financial freedom is the dream… and Digit can help you get there!

Finally, if you want another positive way to improve your life, then read and learn something new every day. A great tool to do this is to join over 1 million others and start your day with the latest FREE, informative news from this website.

DGH Posts On Saving Money:

- 50 Best Frugal Living Tips to Save Real Money

- 11 Good Financial Habits (Tips for Monetary Success and Stability)

- 26 Best Money Habits (Saving, Budgeting, and Increasing Income)

Nicole Krause has been writing both personally and professionally for over 20 years. She holds a dual B.A. in English and Film Studies. Her work has appeared in some of the country’s top publications, major news outlets, online publications and blogs. As a happily married (and extremely busy) mother of four… her articles primarily focus on parenting, marriage, family, finance, organization and product reviews.